GST is a comprehensive indirect tax on manufacture, sale and consumption of goods and services which is to replace multiple taxes levied by the central and state governments. Thus, Goods and Services Tax (GST) is an indirect taxation in India merging most of the existing taxes into single system of taxation. GST is undoubtedly, one of the biggest fiscal reforms in India since Independence impacting each and every business whether small or large.

With the introduction of GST, a new regime of business compliance are introduced. Large enterprises will not face any problems adhering to the compliances since they have the required resources and expertise that can facilitate the compliance management. On the other hand, small and medium enterprises (SME’s) and start-ups will find it difficult in complying with these provisions. Thus, to lower the burden of compliance for small businesses, a composition scheme has been introduced under GST law where the assessees have to pay tax at a minimum rate based on their turnover, provided they fulfill the eligibility criteria.

COMPOSITION SCHEME UNDER GST

The scheme is an alternative way of levy of tax designed for small taxpayers whose turnover is upto Rs. 1 crores (Rs.75 lakhs for few states). The main objective of this scheme is to bring simplicity and to reduce the compliance cost for small taxpayers. It is an optional scheme and the eligible person opting to pay tax under this scheme can pay tax at a prescribed percentage of his turnover every quarter, instead of paying tax at normal rate. The registered taxpayer will have to inform the tax authorities of his intention to be registered under the scheme. In case the registered taxpayer fails to comply with the same he would be treated a normal tax payer and administered accordingly.

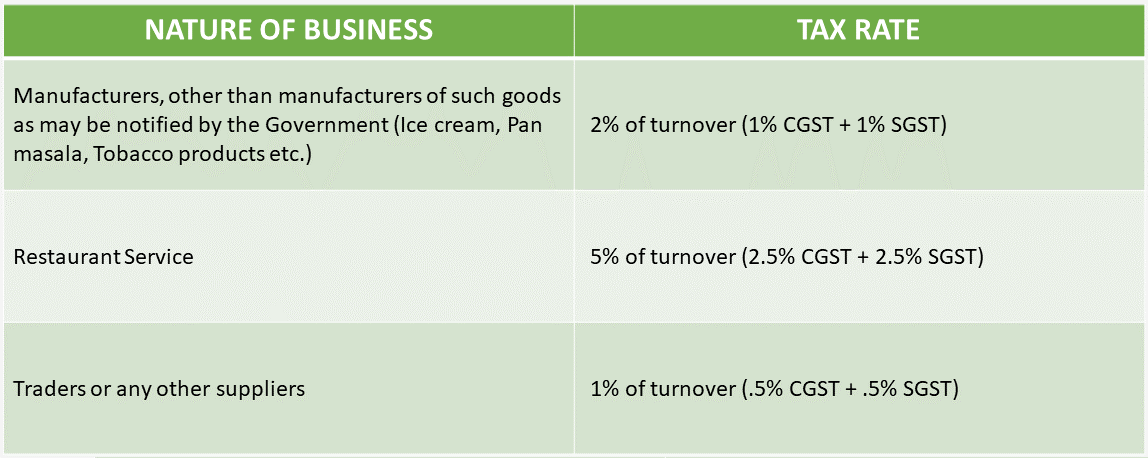

RATE OF TAX APPLICABLE

ELIGIBILITY

Dealers with aggregate turnover of less than Rs. 1 crores in the preceding year are eligible to opt for the scheme. The turnover limit is Rs. 75 lakhs for some States namely Arunachal Pradesh, Assam, Himachal Pradesh, Manipur, Meghalaya, Mizoram, Nagaland, Sikkim, Tripura

Further, if in middle of a Financial year the dealer crosses the threshold limit, as applicable. The option to pay tax under composition scheme lapses from the very day on which the aggregate turnover crosses Rs.1 crores or Rs. 75 lakhs, as applicable. An intimation is required to be filed in Form CMP-04 within 7 days from the day on which threshold limit is crossed.

WHO ARE NOT ELIGIBLE

- Casual traders

- Non-resident taxable person

- Supplier whose aggregate turnover in previous year was more than Rs. 1 crores or 75 lakhs for states, as notified

- Supplier who purchased goods or services from unregistered person unless he has not paid GST on them on reverse charge basis

- Supplier of services, other than restaurant service

- Person supplying exempted goods

- Person making interstate supply

- Supplier selling through e-commerce operator

- Manufacturer of Ice cream and other edible ice (whether or not containing cocoa), Pan masala, Tobacco and manufactured tobacco substitutes

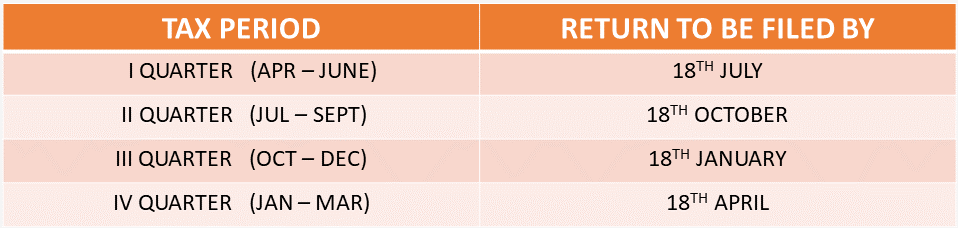

TAX PAYMENT AND RETURNS

A person will have to pay tax on a quarterly basis and then file a simplified return in FORM GSTR 4 on quarterly basis by 18th of the month immediately succeeding the quarter. The return will contain details like turnover of all supplies, tax payable and inward supplies which will be auto-populated in GSTR4A. A normal taxpayer will file 37 returns and on the contrary composition dealer will file just one return for a quarter.

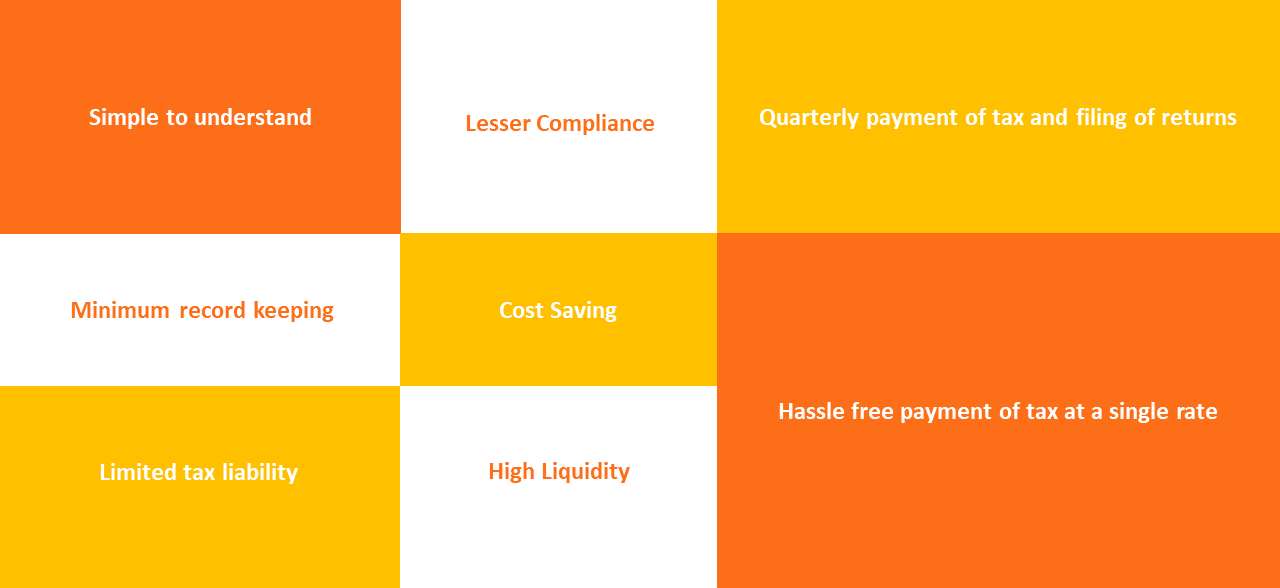

ADVANTAGES

DISADVANTAGES

- No GST can be charged in the invoice and collected from the customer

- Credit of GST paid on inputs cannot be claimed

- Limited Territory for Business (cannot supply goods and services outside the State or to SEZ units)

- Once opted, the scheme will be applicable on all business verticals registered with the same PAN. There will not be any option to pay tax under composition scheme for one and pay tax like a normal taxpayer for other(s)

Eg: A taxable person has a cloth business, footwear business, electronic store business and restaurant business in Delhi with all registered with the same PAN. If composition scheme is opted for just the cloth business then the scheme will also be applicable on other business verticals too.

INVOICING

Such a dealer shall issue a bill of supply and not a tax invoice. Also he shall mention the words “composition taxable person, not eligible to collect tax on supplies” at the top of the bill of supply issued by him.

PENAL PROVISIONS

Under GST if in the opinion of proper officer, it is found that a taxable person is wrongly registered for the scheme have opted for the scheme, he shall be liable to pay differential taxes along with penalty which is equal to 100% of taxes and provisions of demand and recovery will apply to him

TRANSITIONAL PROVISIONS

When a taxpayer is shifting from a normal scheme to composition scheme, the taxpayer has to pay an amount which shall be equal to the credit of input tax in respect to those inputs which are held as stock on the immediately preceding date from the date of such switchover. Any balance which is left in Input Tax Credit account after such payment, then that balance will lapse and not usable.

Any taxpayer who is in Composite Scheme under current regime and transits to Regular Taxation under GST will be allowed to take the credit of Input, semi-finished goods and finished goods on the day immediately preceding the date from which they opt to be taxed as a regular tax payer The inputs can only be availed subject to few conditions such as;

- Those inputs or goods are meant for making taxable outward supplies under GST provisions

- The dealer taking the Input Credit was eligible under the previous regime but could not claim due to registered under Composition Scheme

- The taxpayer claiming Input credit on goods, those goods should be eligible for such credit under GST regime.

- The taxpayer must have a valid legal document of input tax credit i.e. he must possess an invoice evidencing taxes or duties have been paid.

- Those invoices or documents should not be older than 12 months before the appointed date.

REGISTRATION PROCESS

ALREADY REGISTERED UNDER PREVIOUS TAX REGIME

- A person who is registered under previous regimes will migrate to GST and will be given Provisional Certificate.

- Once registered, an intimation in FORM GST CMP-01 will be filed within 30 days after the appointed day(i.e. July 1, 2017) by affixing digital signature or verifying it through electronic verification code (EVC).

- Further, details of stock held has to be furnished, in FORM GST CMP-03 within 60 days in the electronic form.

- Once registered, all provisions applicable for such dealer will squarely apply to him.

SEEKING FRESH REGISTRATION

At the time of registration and while filing Part B of Form GST REG 01 an option for registration under composition scheme of Section 10 (Registration as composite taxpayer)

The scheme is not beneficial to all small businesses and is beneficial for those who do not seek benefits of ITC and supply their goods/services within the State only. Also, the scheme would be of no or less use to those who have business in one or more State.

The restrictions imposed by the scheme do not make it an attractive alternative for the tax payers. Further the tax payers should take a calculative and measured decision by weighing the pros and cons of opting for the scheme and get all figures calculated at first getting a clear picture whether opting for it will be beneficial for them or not.

In case you need any help getting a better understanding of GST and its compliances, as a business owner or as someone who is planning to start a business, feel free to consult the GST experts at Tax Aid. You can get all sorts of assistance on GST Registration, return filing and consultations through experts.