A person registered under GST is required to furnish details of his business inward and outward supplies (purchases and sales) in the form of GST return which is furnished on a regular basis either monthly or quarterly.

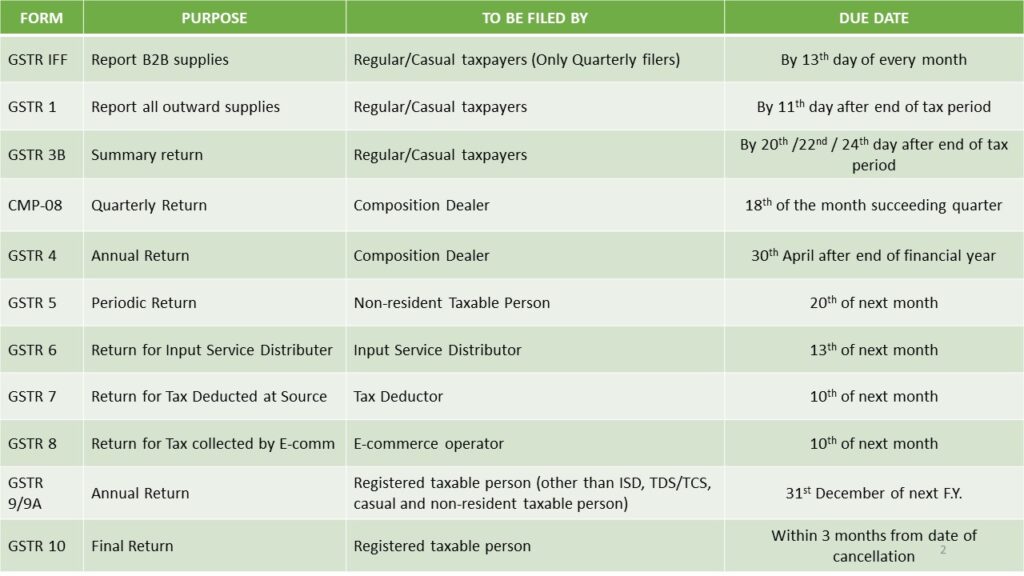

Their are number of forms prescribed under the law for different different types of dealers. Default in filing return within time will lead to imposition of penalty. Also, their is no provision to revise the return, once filed. Hence, it is highly recommended to ensure that the data filed is true and correct by all means.

Filing returns all by yourself could be slightly tricky as with change in circumstances the disclosures made in the return are also affected. Further, under GST there is no such provision to revise a return hence it becomes all more important to ensure that the disclosures are made under the appropriate heads. Any discrepancy in furnishing the details in the rightful manner, can lead to dis-allowing of any claim or imposition of penalty by the Goods and Service tax Department.

WHO SHALL FILE RETURN

TYPES OF RETURN

STEPS TO FILE YOUR GST RETURN

Step 1: Select the applicable plan by clicking “BUY NOW”

Step 2: Kindly provide details, as required in the form

Step 3: Upload necessary documents, as required

Step 4: Click on checkout and you will be redirected to payment screen

Step 5: Make payment

Step 6: We will contact you for further clarifications, if any

Step 7: After processing all the data, collected from you, we will calculate the tax payable and share the details with you

Step 8: Make payment of tax and email us a copy of challan to enable us file your return. Please ensure to mention your firm name and GSTIN in the email body

Step 9: After filing your return, we will send you a confirmation mail along with a copy of return and filing acknowledgment

ADVANTAGES OF FILING WITH US

CHOOSE YOUR PLAN

Accounts

Accounts

Accounts

Domains

Domains

Sub-domains

BASIC

Rs. 499

(all inclusive)

Filing of GST return for dealers with nil turnover

Filing GSTR-3B for one tax period

Filing GSTR-3B for one tax period

PLUS

Rs. 999

(all inclusive)

Filing of GST return for regular dealers

Upto 100 transaction entries

(Rs. 300 extra for every additional 100 entries)

Filing of GST return for composition dealers